As personal injury attorneys in South Florida, we know that spring break can be a time of fun and relaxation for many people. Unfortunately, it can also be a time of increased risk on the roads, as more tourists and party-goers flock to the area.

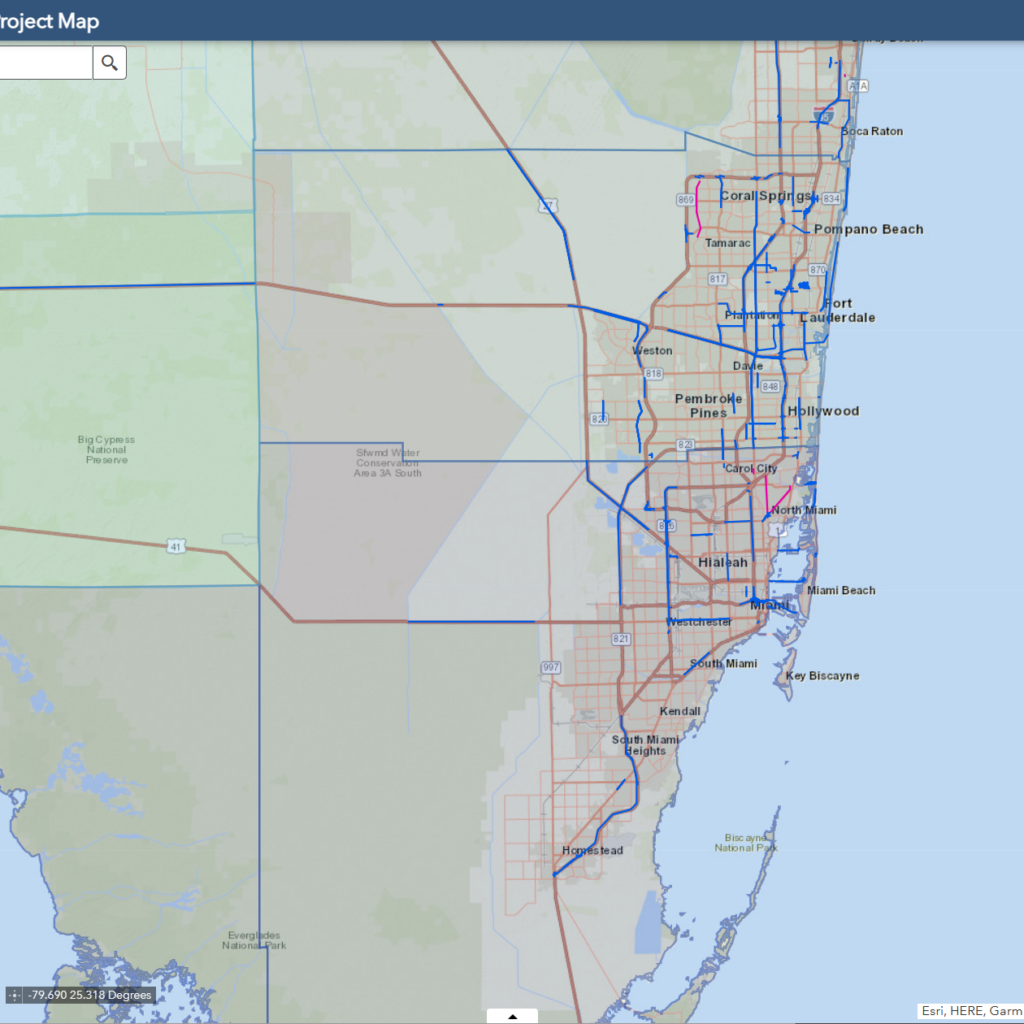

According to a study conducted by the University of Miami, the 14 most popular spring break destinations, including South Florida, saw a 9.1% increase in auto accidents

Here, we’ll take a closer look at the issue of car accidents during spring break in South Florida and what you can do if you are involved in an accident.

Why Are Car Accidents More Common During Spring Break?

Spring break is a time when many college students and tourists come to South Florida to enjoy the warm weather and beach parties. While this can be a fun time, it also means that there are more people on the roads, and many of them may not be familiar with the area or local driving laws. This can lead to a higher risk of accidents, particularly if drivers are distracted, under the influence of drugs or alcohol, or simply not paying attention to the road.

Common Causes of Car Accidents During Spring Break

At South Florida Injury Law Firm, we have seen firsthand the devastating consequences of car accidents during spring break. Here are some of the factors that can contribute to car accidents during this time of year:

Increased traffic

With more people on the roads during spring break, traffic can be heavier and more congested than usual. This can lead to more accidents, especially in areas where there are a lot of tourists and visitors who may be unfamiliar with the local roads.

Impaired driving

Unfortunately, spring break is also a time when many people engage in excessive drinking and drug use. This can lead to impaired driving, which is a leading cause of car accidents during this time of year.

Distracted driving

With so much to see and do during spring break, it’s easy to become distracted while driving. This can include texting or using social media, taking photos or videos, or even just looking at the sights and sounds around you.

Road construction

There is a number of ongoing road construction and maintenance being performed on major roads throughout South Florida and is also a common time for road construction projects to begin, which can lead to traffic disruptions and increased risk of accidents.

Driving under the influence

Many people come to South Florida to party, and unfortunately, this often leads to an increase in drunk driving accidents.

Speeding

With so many people on the roads, drivers may feel pressure to get to their destination quickly, which can lead to speeding and reckless driving.

Inexperienced drivers

Many tourists and college students may not be familiar with the area or local driving laws, which can lead to confusion and accidents.

What Should You Do If You’re Involved in an Accident During Spring Break?

If you are involved in a car accident during spring break in South Florida, it’s important to take the following steps:

Call the police

Even if the accident seems minor, it’s important to call the police and have them document the accident. This can be important if you need to file a claim with your insurance company or if you need to pursue legal action.

Seek medical attention

Even if you feel fine after the accident, it’s a good idea to seek medical attention to make sure that you don’t have any hidden injuries. Some injuries, like whiplash or concussions, may not show symptoms right away.

Gather evidence

Take photos of the accident scene, get contact information from any witnesses, and make note of any relevant details about the accident.

Exchange information

Be sure to exchange contact and insurance information with the other driver involved in the accident.

Contact an attorney

If you’ve been injured in an accident during spring break, it’s important to contact a personal injury attorney who can help you understand your legal options and pursue compensation for your injuries.

How Can You Stay Safe During Spring Break?

If you’re planning to visit South Florida for spring break, there are several things you can do to stay safe on the roads, including:

Avoid distracted driving

Put your phone away and avoid other distractions while driving.

Don’t drink and drive

If you plan to drink, make sure that you have a designated driver or use a ride-sharing service like Uber or Lyft.

Obey traffic laws

Follow the speed limit and other traffic laws to avoid accidents.

Be aware of your surroundings

Pay attention to other drivers and pedestrians on the roads, and be aware of any hazards or obstacles.

Spring break can be a fun and exciting time in South Florida, but it’s important to remember that the roads can be dangerous during this time. By following the tips outlined in this blog post and staying aware of your surroundings, you can help reduce your risk of being involved in a car accident. If you are injured in an accident during spring break, be sure to contact an experienced personal injury attorney.

At The South Florida Injury Law Firm, we have extensive experience helping clients who have been injured in car accidents during spring break. We understand the unique challenges that this time of year can present, and we are dedicated to helping our clients get the justice and compensation they deserve.